Attention globetrotters and online shoppers! As you’re gearing up for the holiday season, a heads-up: starting from 1 December 2023, the Commonwealth Bank (CBA) is set to increase its international transaction fees from 3% to 3.5%. And it’s not just CBA; ANZ, NAB, and Westpac, the rest of Australia’s ‘Big Four’, all levy a 3% international transaction fee.

So, what exactly is an international transaction fee? It’s a charge applied to purchases or cash advances that occur overseas or have an overseas connection—such as an international merchant or financial institution—even if the transaction is in Australian dollars.

Here’s where ubank makes a world of difference. With ubank’s Spend account, you can wave goodbye to international transaction fees altogether. That’s right, zero fees for your transactions abroad or online with foreign retailers.

Imagine this: Lucy and James are planning their festive trip to Tokyo. While others may worry about extra charges, our savvy couple books their flights and accommodations with ubank, avoiding the 3.5% fee completely. The savings? They turned into extra sushi dinners and a traditional tea ceremony experience, which became the highlight of their trip.

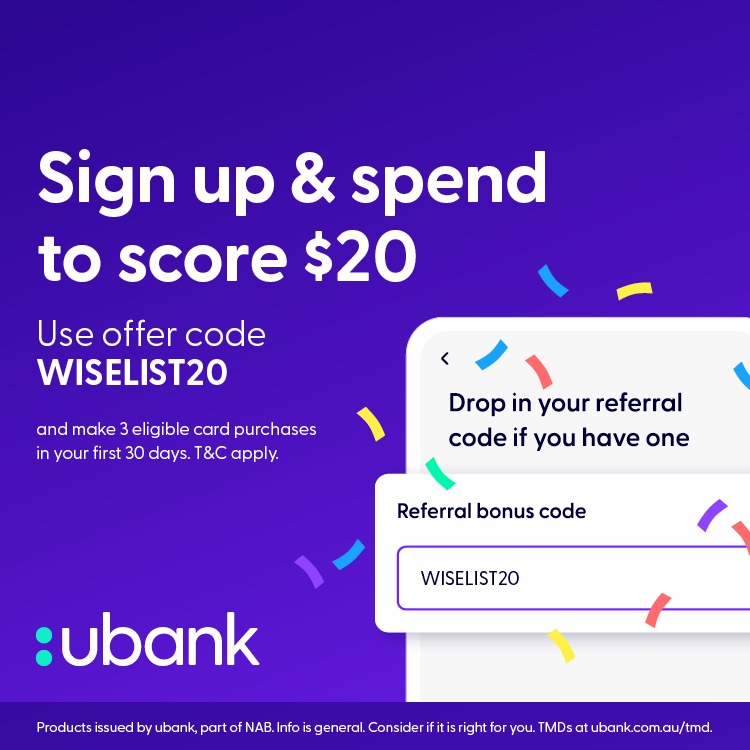

And for WiseList users, it gets even better. Sign up with ubank in just minutes, use the code ‘WISELIST20’, and after making 3 card purchases in 30 days, you’ll get a welcome $20 in your account. It’s simple, smart, and speedy.

Don’t let bank fees dampen your holiday spirit. Join ubank and WiseList now, and keep your hard-earned money for the joys of the season.

Sign up Ubank and Score $20 Bonus

Code:WISELIST20

Limited time offer. Terms apply.

0 Comments